How Market Trends Affect Real Estate Appraisals is a crucial topic for anyone involved in buying, selling, or investing in real estate. Understanding how market dynamics influence property values can empower homeowners and investors to make informed decisions. Whether it’s a booming market or a downturn, the effects of these trends on appraisals can determine the financial success of a real estate transaction.

This exploration delves into the intricacies of real estate appraisal, clarifying how various market trends, such as economic shifts and location desirability, shape property valuations. From comprehension of different appraisal types to the vital role of appraisers, this discussion aims to equip readers with valuable insights that enhance their grasp of real estate appraisals and their dependency on market trends.

Welcome to the fascinating world of real estate appraisal! If you’re a homeowner, a prospective buyer, or even an investor, understanding the value of real estate is key to making informed decisions. In this post, we’ll delve into what real estate appraisers do, the methodologies they use, and why their insights are vital in the ever-evolving market. So, grab a cup of coffee, get comfy, and let’s explore!

What is Real Estate Appraisal?

At its core, real estate appraisal is the process of developing an opinion of the value of a property. This process is usually carried out by a certified or licensed appraiser who takes into account various factors, including the property’s location, condition, and the current market conditions. Unlike a real estate agent, whose primary goal is to sell properties, an appraiser provides an independent assessment of a property’s value, which can be crucial for both buyers and sellers.

Why is Appraisal Important?

Appraisals play a vital role in the real estate market for several reasons:

- Financing: Lenders require appraisals to ensure that the property is worth the amount they are lending. This protects them from loaning more than the property is worth.

- Taxation: Property taxes are often based on the appraised value of a property. A fair appraisal ensures that homeowners aren’t over-taxed.

- Market Understanding: For buyers and sellers, an appraisal provides an objective assessment of value, helping them make informed decisions.

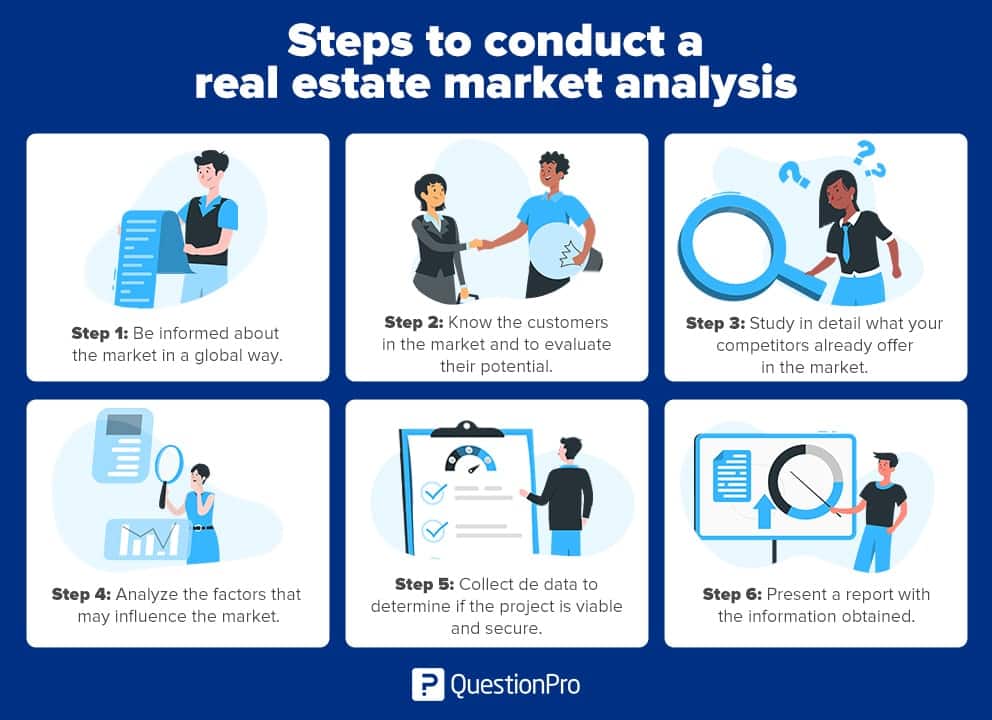

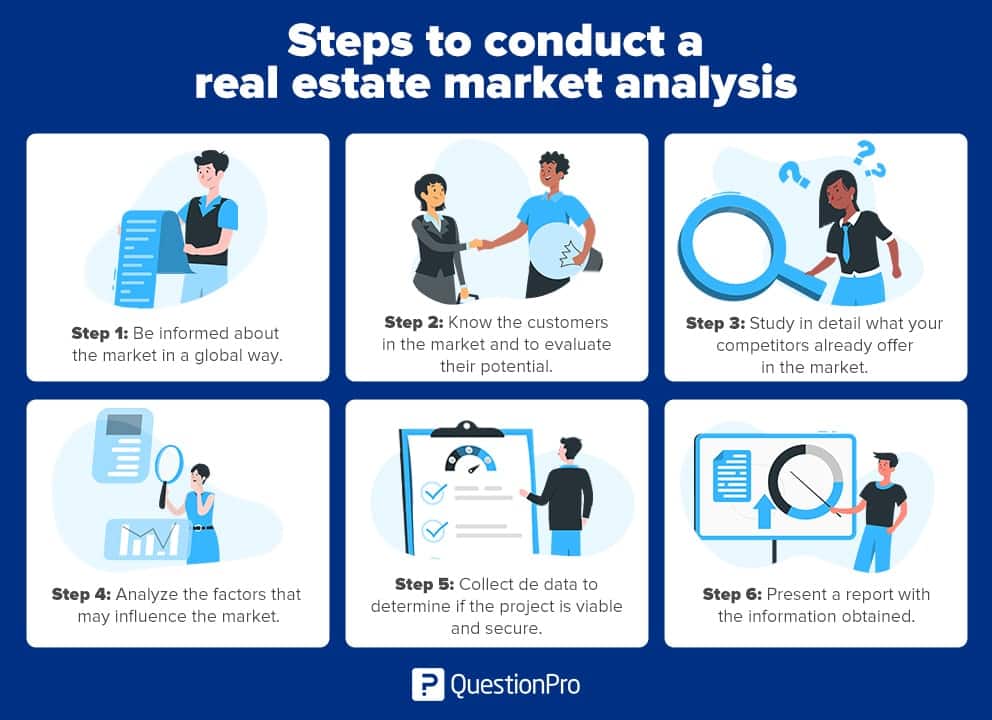

The Appraisal Process: How Market Trends Affect Real Estate Appraisals

Now let’s break down the steps involved in the appraisal process. Understanding this will help demystify what appraisers do and how they determine property value.

1. Initial Consultation

The process begins with an initial consultation where the appraiser reviews the property’s details. This can include looking at the property’s size, condition, and unique features. The appraiser will also gather information about the local real estate market.

2. Property Inspection

The next step is a thorough inspection of the property. This includes not just the interior and exterior of the home, but also the surrounding area. The appraiser looks for any upgrades, repairs needed, or potential issues that could affect the property’s value. This on-site visit is crucial, as it allows the appraiser to gather firsthand information.

3. Comparative Market Analysis (CMA), How Market Trends Affect Real Estate Appraisals

After the inspection, the appraiser will conduct a Comparative Market Analysis (CMA). This involves examining recent sales of similar properties in the area, also known as “comparables” or “comps.” This analysis helps the appraiser gauge the market conditions and establish a baseline for the property’s value.

4. Valuation Approaches

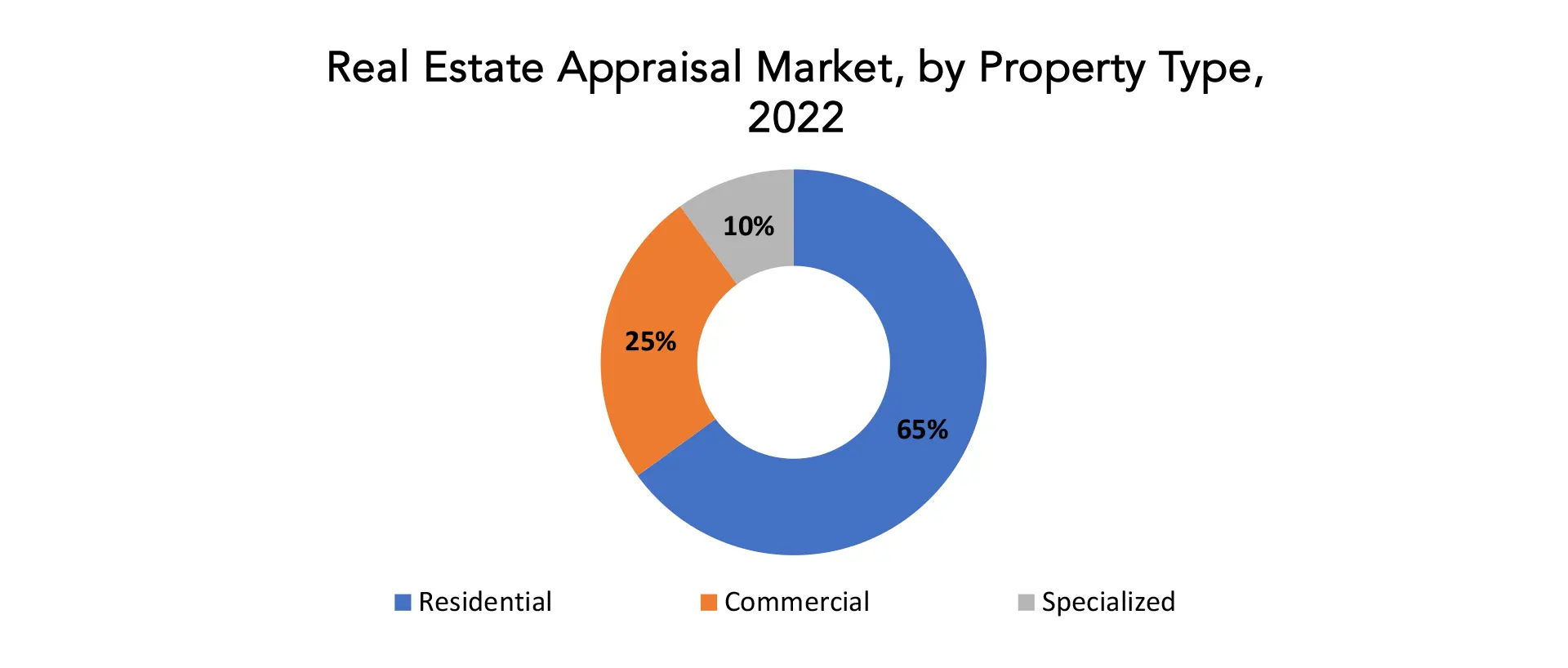

Appraisers typically use three different approaches to determine property value:

- Sales Comparison Approach: This is the most common method, where the appraiser compares the property to similar properties that have sold recently.

- Cost Approach: This method assesses what it would cost to replace the property, taking into account depreciation and the value of the land.

- Income Approach: Typically used for investment properties, this approach evaluates the income-generating potential of the property.

5. Final Report

After completing the necessary analysis, the appraiser compiles their findings into a detailed report. This report will include the appraiser’s opinion of the property value, the methods used to arrive at that value, and justification for the valuation. This document is essential for lenders and can also help buyers and sellers in negotiations.

Common Misconceptions About Appraisals

There are several common misconceptions about real estate appraisals that can confuse homeowners and buyers alike:

- Appraisers are biased: A professional appraiser is trained to provide an objective assessment. They must adhere to strict ethical guidelines to ensure their evaluations are fair and unbiased.

- Higher appraisals are better: While a higher appraisal can be beneficial for sellers, it might not always be a good thing for buyers if it leads to overpaying for a property.

- Appraisals are the same as home inspections: While appraisals and home inspections both assess properties, their purposes are different. Inspections focus on the property’s condition, while appraisals focus on its value.

Tips for Homeowners and Buyers

Whether you’re selling your home or looking to buy, here are some tips to keep in mind:

- Prepare Your Home: If you’re selling, make sure your home is in good condition and consider any small upgrades that could enhance value.

- Educate Yourself on the Market: Understanding current market trends can help you gauge what to expect from an appraisal.

- Ask Questions: During the appraisal process, don’t hesitate to ask the appraiser questions. Understanding their methodology can provide valuable insights.

Conclusion

Real estate appraisal is an essential service that provides clarity in the often murky waters of property valuation. Whether you’re a buyer, seller, or investor, understanding the appraisal process can empower you to make better decisions in your real estate endeavors. Remember, when in doubt, reach out to a certified appraiser—they’re your best ally in understanding the true worth of your property.

Thanks for joining me on this exploration of real estate appraisal! Stay tuned for more insights and tips on navigating the real estate market!

Frequently Asked Questions

What is the difference between an appraisal and a home inspection?

An appraisal estimates the property’s market value, while a home inspection assesses the condition of the property.

How do market trends influence appraisal values?

Market trends, such as supply and demand, economic indicators, and location desirability, can significantly alter property valuations during appraisals.

Can I influence my property’s appraisal value?

Yes, by maintaining the property, making upgrades, and presenting it well during the appraisal process, you can influence its value positively.

How often should real estate appraisals be conducted?

Appraisals are typically conducted during a sale, refinancing, or when there are significant changes in the market or property conditions.

What should I do if I disagree with my appraisal?

If you disagree with an appraisal, you can request a review, provide additional data, or seek a second opinion from another appraiser.